Governments globally are stepping up efforts to ensure level playing fields and stamp out anticompetitive behaviour and regionally it is no different.

Last year saw an increase in antitrust enforcement throughout the Asia-Pacific region (Apac), with the Philippines and Indonesia leading Asean in ramping up anticompetitive enforcement, the details of which are contained in this year’s edition of PaRR’s Global Trends Monitor.

Issued each year to track antitrust activity globally, the latest edition shows the Philippines moving up two places year-on-year (YoY), from eighth ranking in 2017 to sixth last year, for most active jurisdictions in Apac. Indonesia saw its ranking on the APAC table move from seventh place last year to sixth this year, while Malaysia retained its 10th position for a second consecutive year. Cambodia, the report noted, remained one of the of the least active jurisdictions in the region with less antitrust activity reported over the period.

Commenting on this year’s report, Raymond Barrett, managing editor, said 2018 reflected the forecast issued by the company a year earlier of ‘governments increasingly determined to use their regulatory regimes as both tools of industrial policy and political expediency’.

Notable antitrust activity across Apac in 2018

- Asean member-nations established an antitrust enforcers’ network in October known as the Asean Competition Enforcers’ Network (Acen) to facilitate cooperation on competition cases in the region and to serve as a platform to handle cross-border cases.

unchanged year/year. PaRR

- In Indonesia, in April, the President appointed nine new competition commissioners. Antitrust lecturer Kurnia Toha was picked as the new competition chief the following month.In September, the top court upheld the dismissal of IDR117.7 billion (about US$ 8.7mln) in poultry cartel fines. In December the antitrust authority began hearings on a salt cartel case, while the same month the Supreme Court upheld 2016 penalties on lot feeders.

- In Malaysia, in September, Mohd Hishamudin Md Yunus was appointed competition chief. The 1MDB saga continued to grab the headlines and charges were filed against Goldman Sachs and former prime minister Najib Razak in December.

- In Myanmar, the government in May eased foreign investment rules for the retail and wholesale sectors.

- In Singapore, lawmakers passed a bill bolstering cybersecurity in February and approved amendments to the competition law the following month.In September, the antitrust agency fined chicken suppliers a record S$27 million ($19.6 mln), and also imposed remedies and penalties on Grab and Uber over their merger.In November, the health ministry published fee benchmarks for common surgical procedures conducted by private sector professionals. The monetary authority announced in December a lifetime ban against the former director at Goldman Sachs for 1MDB-related breaches.

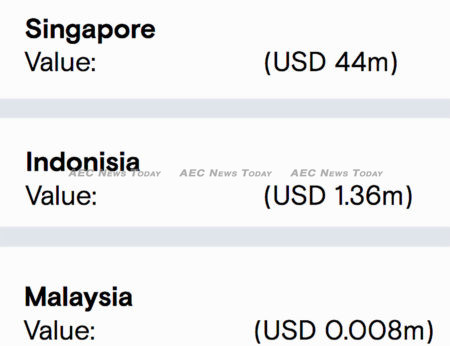

Finalised anti-trust penalties imposed in Asean during 2018 PaRR

- In the Philippines, the antitrust agency in March raised the merger notification threshold to PHP5 billion ($96 mln). The following month, it published a draft of guidelines for joint ventures.The regulator also began reviewing the merger of Uber’s local operations with Grab in April, subsequently imposing a PHP16 million ($305,518) fine on the parties in October for breaching interim measures.The following month, a Mislatel-led consortium was named as the country’s third telco amid a senate inquiry, and the competition commission unveiled proposed rules for its leniency programme which took effect in January 2019.

- In Thailand, in December, Global Power Synergy (GPSC)’s acquisition of Glow Energy was granted conditional clearance.

- In Vietnam, in June the National Assembly (NA) approved amendments to the competition law. In December the trade ministry said the Grab-Uber deal likely violated competition norms. Meanwhile, a court ordered Grab to pay rival Vinasun VND4.8 billion ($206,577.3) in compensation for anticompetitive conduct.

Produced by PaRR, a global business intelligence service that provides the only antitrust enforcement, merger reviews, and litigation news service, Global Trends Monitor analyses the most active jurisdiction, sectors and fines by splitting them into top 10 sectors in public and private competition law enforcement. According to the report in 2018 internet/e-commerce matters dominated the antitrust agenda throughout APAC, followed by the transportation and telecommunication carrier sectors.

Related:

- Southeast Asia awakens to the power of corporate competition (Nikkei Asian Review)

- ASEAN competition and telecommunications regulators strengthen relations (Philippines Information Agency)

- Grab to tackle ASEAN’s traffic tangles amid antitrust pressure (Nikkei Asian Review)

- Vietnamese authorities set to probe Grab-Uber deal again (The Phnom Penh Post)

She commenced as an intern at AEC News Today and was appointed as a junior writer/ trainee journalist on April 2, 2018

Latest posts by Sreypov Men (see all)

- Myanmar morning news for July 24 – July 24, 2020

- Vietnam morning news for July 24 – July 24, 2020

- Malaysia morning news for July 24 – July 24, 2020

- Myanmar morning news for July 23 – July 23, 2020