The International Air Transport Association (IATA) has doubled-down on its March forecast of the challenges facing the international civil aviation industry, last month forecasting that the lock-downs and border closures could cost Asean airlines $38.2 billion in revenues this year and see the axing of some 7.2 million jobs.

The airline trade association forecasts COVID-19 will see global passenger revenues drop by some $314 billion globally this year, a 55 per cent year-on-year (YoY) decline. Asia-Pacific airlines set to see the largest fall with a drop of $113 billion. In its earlier forecast issued in March the association had forecast an estimated $88 billion loss for the year.

Passenger demand is similarly forecast to decline with the full year expected to see a 50 per cent drop YoY, up from the 37 per cent decline forecast in March.

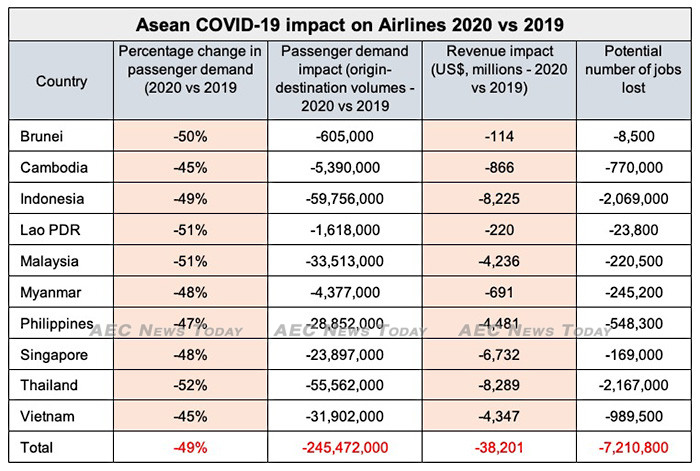

Across Asean member states passenger air traffic is expected to drop by an average 49 per cent compared to 2019, with Thailand, Malaysia, and Lao expected to see the largest falls in passenger demand.

Thailand forecast to be biggest aviation loser

Thailand is forecast to experience the largest loss in revenue at $8.289 billion, marginally ahead of Indonesia at $8.225 billion, with more than four million jobs expected to be lost in these two countries alone.

“The situation is deteriorating. Airlines are in survival mode. They face a liquidity crisis with a $61 billion cash burn in the second quarter, said, IATA’s regional vice president, Asia-Pacific, Conrad Clifford.

Referring to the appointment of administrators by Virgin Australia, Mr Clifford said there will be more casualties if governments do not step in urgently to ensure airlines have sufficient cash flow to tide them over this period, pointing to Indonesia, Malaysia, the Philippines, and Thailand as locations where governments need to act urgently if they are to save their airlines.

According to IATA its revised forecast is based on a situation where travel restrictions linger for three months, with a gradual lifting of restrictions in domestic markets, followed by regional, and international routes.

The airline body’s revision comes as the global economy continues its descent into the abyss, with the time until airtravel returns to pre-COVID-19 levels being put by some airlines as “many years”, with IATA claiming global passenger volumes have returned to levels last seen in 2006.

In March IATA wrote to the heads of all governments in the Asia-Pacific appealing for emergency financial support for airlines, claiming the industry faced an $88-billion revenue loss and a 37 per drop in passenger demand (See: Mayday, mayday, mayday: “It’s apocalypse now” for Asia-Pacific airlines — IATA Boss).

Meanwhile, the Association of Asia-Pacific Airlines (AAPA) said last month that the number of flights operated across the region had dropped 93 per cent in the first week of April on the back of border closures.

However, in a recent statement the group said governments must apply caution in their move to ease mobility restrictions, urging coordination in developing common standards and re-establishing mutual trust.

While some limited domestic flights have resumed in Thailand, Malaysia, and Vietnam, social distancing requirements and public fear have industry watchers looking on with interest, the civil aviation industry across the region is in critical care, waiting to see how much life support will be provided.

March air traffic numbers plunge

With international borders closed, previous visas cancelled and new ones not being issued, international air travel throughout the region is almost non-existent, except by diplomats and citizens returning home.

Singapore’s Changi Airport said that its March traffic fell by 70 per cent YoY, while Malaysia reported a 63 per cent YoY decline over the same period. The Airports Authority of Thailand (AOT) said last week that it expects air traffic to decrease by 53 per cent this year.

In the Philippines Cebu Air, operator of Philippines low cost carrier Cebu Pacific, last Wednesday reported a net loss of PHP1.18 billion (about US$23.336 mln) in the first quarter of the year, 135.2 per cent lower than for the same period in 2019, while Thai Airways International is set to receive a $1.8 billion lifeline from the Thailand government.

If the civil aviation industry needed any more bad news it came last Friday (May 1) when billionaire US investment guru and philanthropist Warren Buffett’s Berkshire Hathaway dumped its entire airline portfolio, comprising America’s top four airlines.

Acknowledging that the trade and seen the group incur a considerable loss, Mr Buffett added salt to the aviation industry’s industry’s wounds by saying “the world changed for airlines”.

Feature photo John Le Fevre

Related:

- COVID19: Airlines in Asia Pacific to See Largest Drop in Revenue (Travel News Asia)

- AirAsia will not take jet deliveries this year, revisiting Airbus order book (Reuters)

- Domestic Travel to Lead Recovery Followed by Regional and Intercontinental Services (Travel News Asia)

Stella-maris Ewudolu

Between November 2010 and February 2012 she was a staff writer at Daylight Online, Nigeria writing on health, fashion, and relationships. From 2010 – 2017 she worked as a freelance screen writer for ‘Nollywood’, Nigeria.

She joined AEC News Today in December 2016.

Latest posts by Stella-maris Ewudolu (see all)

- Zoonotic crossover fear sees Vietnam ban (almost) all wildlife trade (video) – July 26, 2020

- Job & revenue losses: COVID-19 to hurt Asean airlines the most – July 24, 2020

- Philippines morning news for July 24 – July 24, 2020

- Philippines morning news for July 23 – July 23, 2020